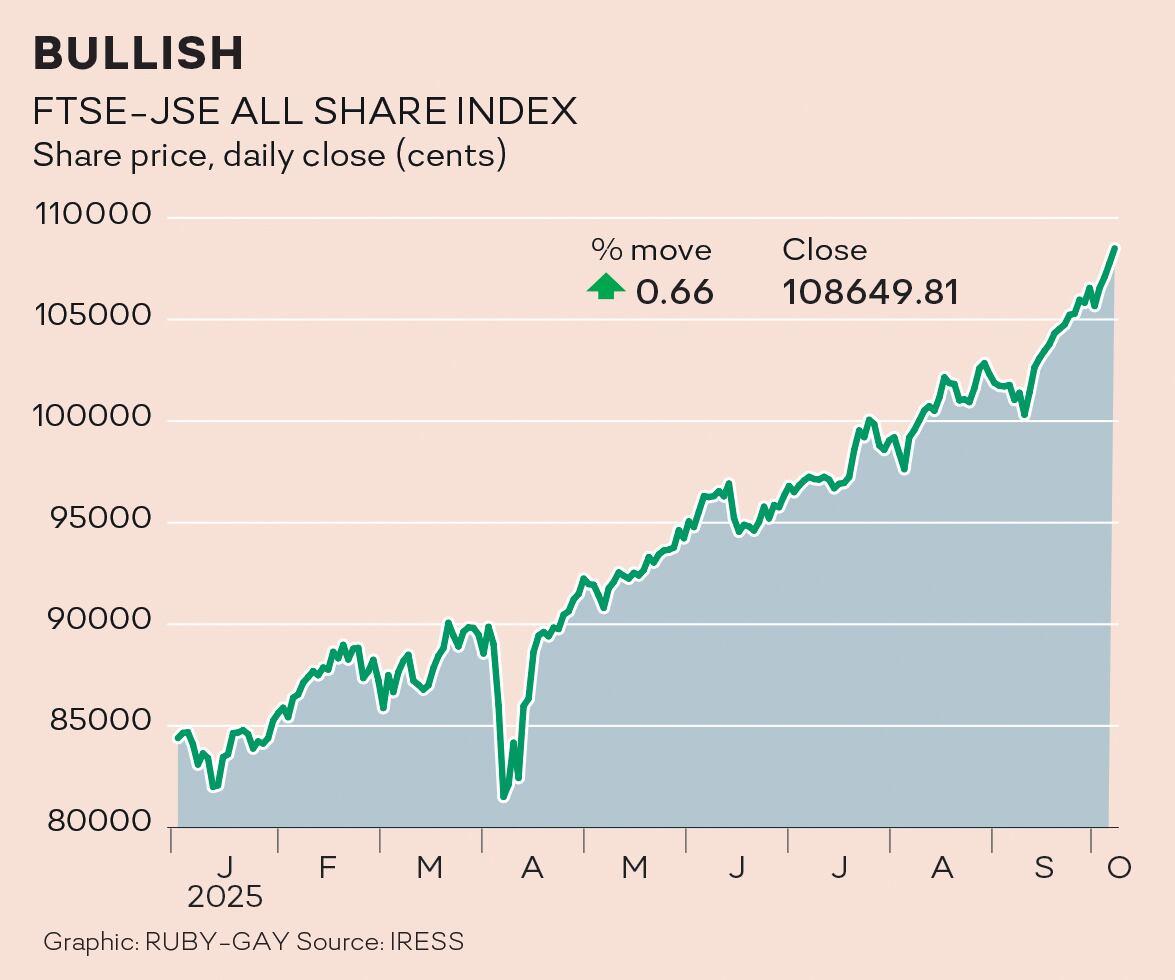

Momentum Investments says SA assets are poised for further growth after a stellar year in which the all share index (Alsi) broke new ground on a consistent basis, breaching the 100,000-point mark for the first time in the JSE’s 137-year history.

Herman van Papendorp, head of asset allocation at Momentum Investments, said SA-listed companies have negligible revenue exposure to the US and should thus not experience a notable direct negative impact from the announced 30% tariff increase on SA imports by the US.

He added that the SA equity market remains under-owned within global emerging market funds.

“Recent research by UBS shows that SA-listed companies have negligible revenue exposure to the US and should thus not experience a notable direct negative impact from the announced 30% tariff increase on SA imports,” Van Papendorp said.

“With the SA equity market one of the strongest global equity performers so far in 2025, this could put the overlooked market back onto the radar screens of foreign investors, as has often been the case in the past,” according to Van Papendorp.

“While SA remains in a falling local interest-rate cycle, this continues to provide a positive backdrop for both local equities and vanilla government bonds. Both these asset classes also remain attractively valued within the emerging market peer group, as well as relative to their own histories”.

The Alsi, the broadest measure of SA’s stock market performance, has had a strong start to the year, following on an equally strong rally since the formation of the government of national unity a year ago.

At the start of the second quarter of the year, the Alsi was just under 90,000 points and has since added more than 16,000 points even as US President Donald Trump’s tariffs weighed on global markets.

The SA equity market was up 14.7% in the first six months of this year, the strongest first-half performance since the 17.4% growth in the first half of 2006. It has experienced one of the broadest recoveries within global equity markets since Trump’s “Liberation Day” tariff scare in early April, according to research by Deutsche Bank.

Van Papendorp said the group still favours SA assets over global counterparts, supported by fundamental and valuation considerations. “SA continues to stand out as a superior dividend market, with forward dividend yields currently 27% above the emerging markets average, slightly above its long-term premium of 25%.”

Updated: October 2 2025

The story has been updated for clarity

Would you like to comment on this article?

Sign up (it's quick and free) or sign in now.

Please read our Comment Policy before commenting.